Forms

SOME AGENCIES REQUIRE A DEDUCTION CARD

If your agency is listed below, please complete an application AND a deduction card.

Click on the form you wish to use, then fill it out online.

Application and Change/Termination forms are completed electronically via this site. Payroll Deduction forms are handled separately (see below for more information).

Application

To enroll, please fill out this form completely and select submit. Forms can only be processed during open enrollment season (October 1-31 of each year), or within the first 30 days of employment/swearing in.

Payroll Deduction Form

The agencies below require a payroll deduction card to authorize automatic deduction of dues. This is submitted to your agency’s Director, to be passed along to your Payroll or HR department. Your enrollment is not complete unless BOTH have been submitted.

Change/Termination Form

This form will handle all changes (beneficiary, name changes, termination of membership) and can be submitted at any time. Please fill it out completely and select submit.

Application

To enroll, please fill out this form completely and select submit. Forms can only be processed during open enrollment season (October 1-31 of each year), or within the first 30 days of employment/swearing in.

Payroll Deduction Form

The jurisdictions below require a payroll deduction card to authorize automatic deduction of dues. This is submitted to your agency’s Director, to be passed along to your Payroll or HR department. Your enrollment is not complete unless both the application AND deduction card have been submitted.

Change/Termination Form

This form will handle all changes (beneficiary, name changes, termination of membership) and can be submitted at any time. Please fill it out completely and select submit.

Frequently asked questions

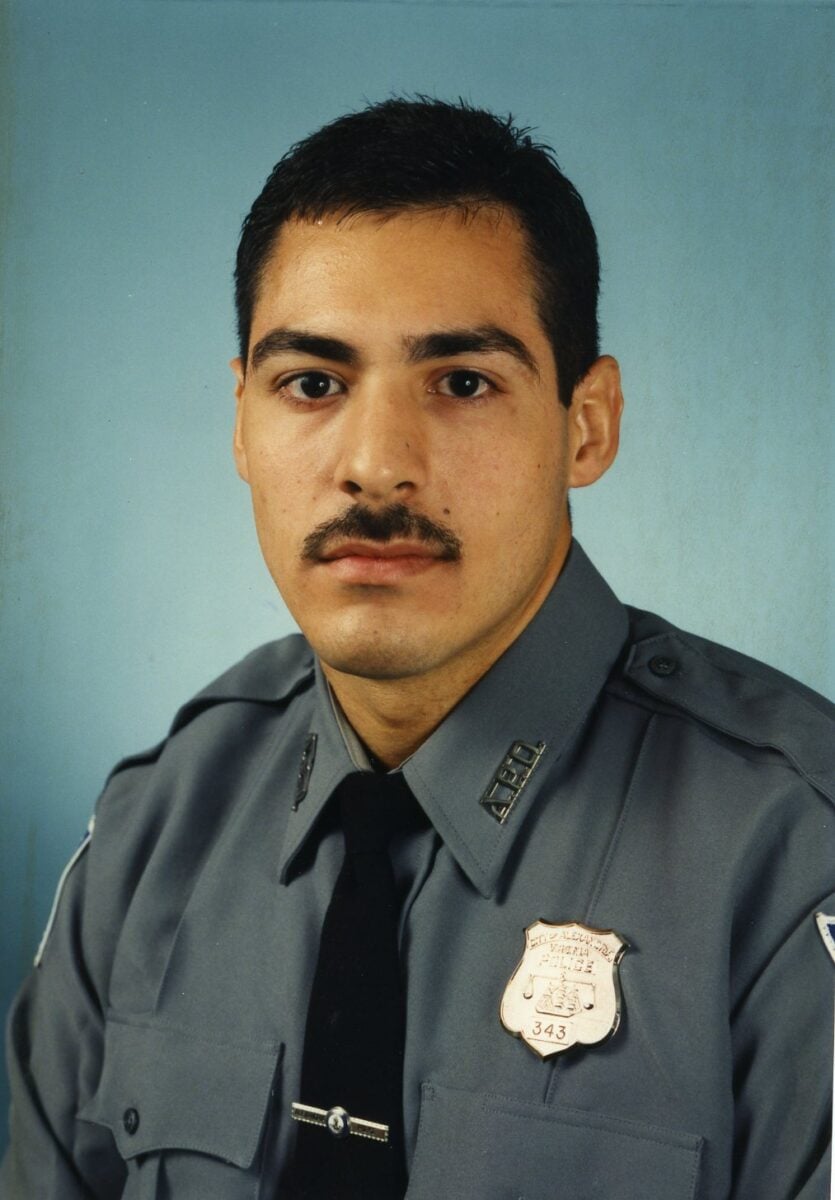

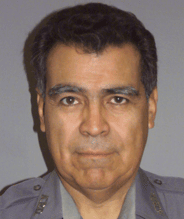

Memorial

Our goal is to help the family of a member after the member's death. The following Deputies, Officers, and Civilians were members of the Law Enforcement Benevolent Fund, and their families received the full benefit the Fund provides.

Questions

Do you have additional questions about applying for benefits or updating your information? Please contact your agency’s director via our form.

Questions

Do you have additional questions about applying for benefits or updating your information? Please contact your agency’s director via our form.